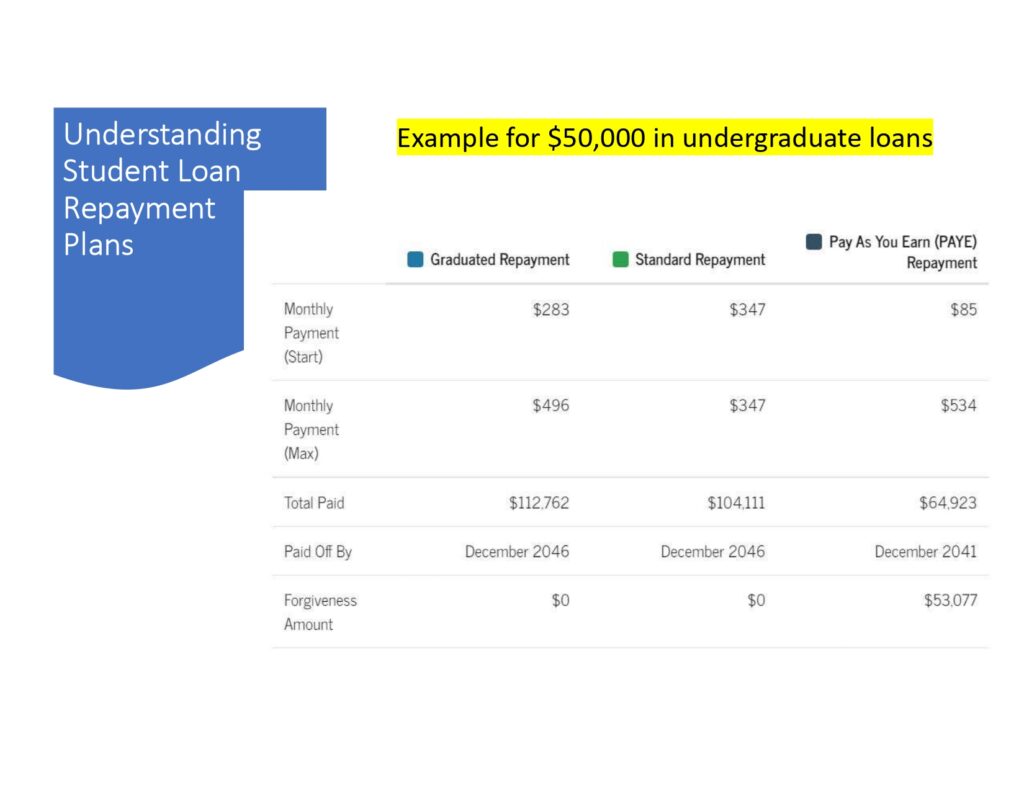

Helping You Understand Student Loan Repayment Plans

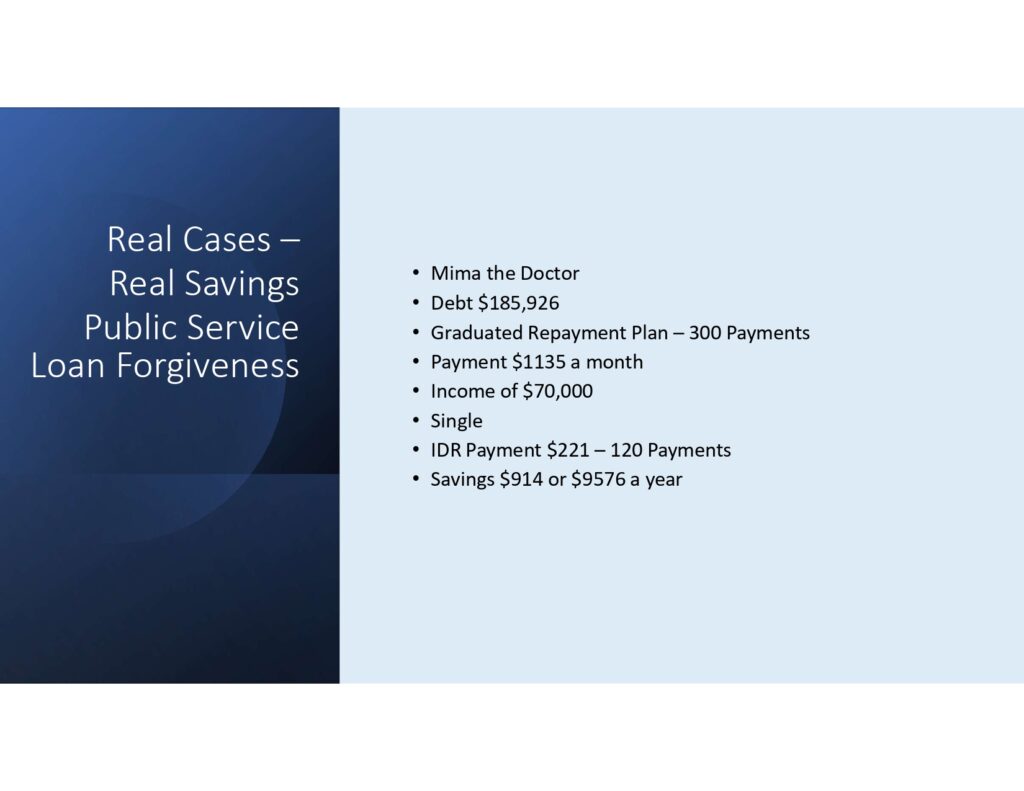

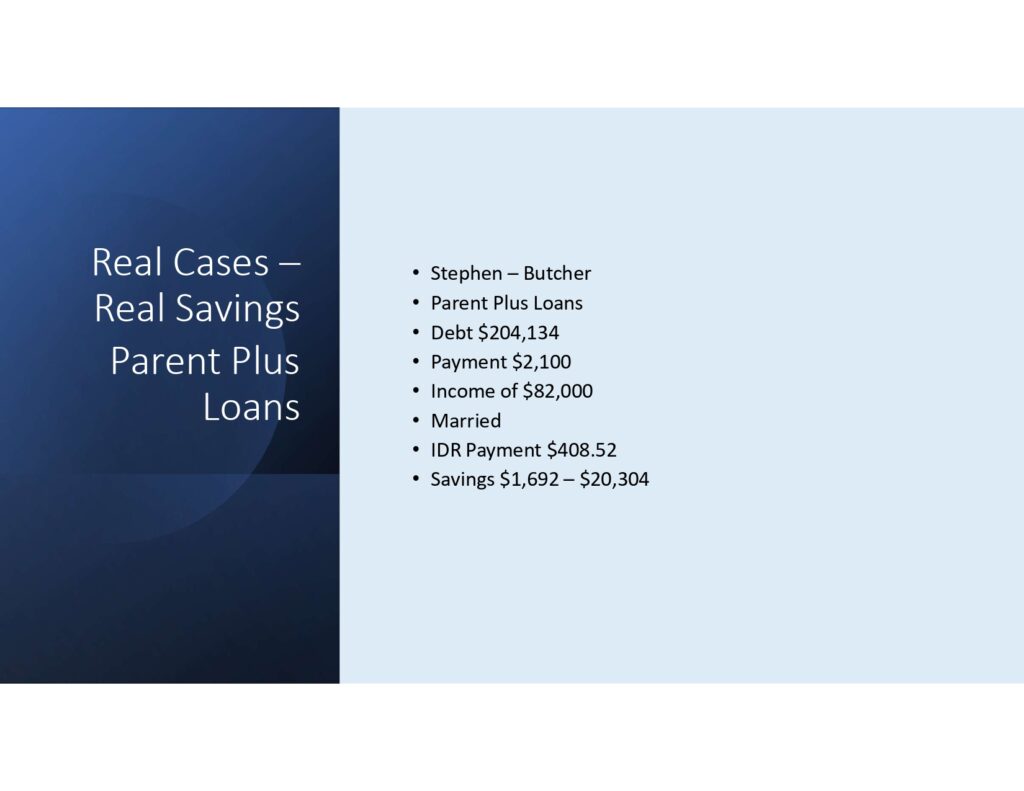

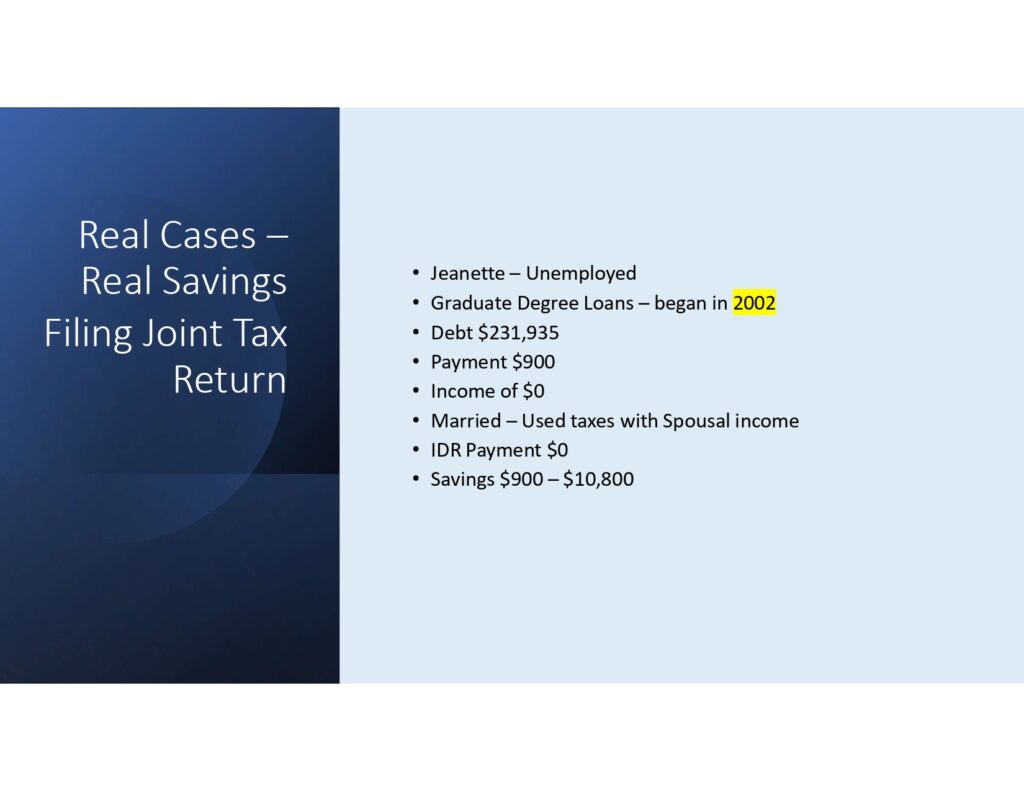

Discover the best way to manage your student loan repayment with the help of FSLRA. Our knowledgeable advisors will help you understand various student loan repayment plans and how they can work for your situation. Over the years, we have provided expert guidance to many people by evaluating repayment programs by the Department of Education. Through our services, our clients have saved thousands of dollars in interest payments and achieved loan forgiveness.

- Educate the borrower how repayment works.

- Evaluate Cost of Current Loan Repayment Plan.

(Many Borrowers are in the wrong repayment Plan) - Determine the repayment option that offers the lowest payment with forgiveness options.

- Ascertain the lowest income options to submit.

Personalized Services

We treat each of our clients with the compassion and respect and attention they deserve. Our clients have access to their accounts on our client portal showing them where they are in the process!